Rated 4.9 stars on

Google Reviews

Table of Contents

Notifyre is excited to be partnering with the Australian Competition & Consumer Commission (ACCC) and the Scams Awareness Network (SAN) to participate in this year’s Scams Awareness Week, running from November 8 through to November 12.

What is Scams Awareness Week?

Scams Awareness Week is an annual education and awareness initiative of the Scams Awareness Network, supported by Notifyre. Scams cost Australians, businesses and the economy millions of dollars each year and can cause serious emotional harm to those impacted, and their families. In 2020 alone, reported losses exceeded $851 million, over $200 million more than 2019 due to scammers using the COVID-19 pandemic to take advantage of vulnerable people and businesses during these uncertain times.

The 2021 Scams Awareness Week theme, let’s talk scams, focuses on encouraging everyone to talk about scams and the financial and emotional impact they can have on someone. As an official partner of Scams Awareness Week, we encourage you all to have a chat and check-in with family, friends or colleagues with a focus on scams. Just starting a conversation may have a massive impact on someone you know, providing them with the opportunity to confide in you or seek further support.

The Role of SMS in Scam Prevention

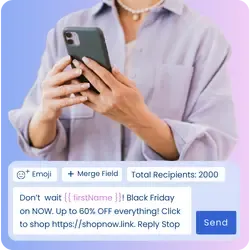

In an age where digital threats are becoming more sophisticated, SMS messaging remains one of the most effective tools for raising scam awareness and protecting customers. With open rates as high as 98%, SMS ensures your message is seen, making it the ideal channel for scam alerts, 2FA codes, and security tips.

Protecting Customers from Scams with 2FA and Secure Messaging

Businesses can play a pivotal role in safeguarding customers from scams by implementing robust security measures like two-factor authentication (2FA) and secure online messaging. By adding these layers of protection, businesses can ensure that customers’ accounts and sensitive information are better shielded from unauthorized access. Combining 2FA with secure text messaging not only boosts trust but also educates customers about the importance of secure practices in their digital interactions.

Key Steps Businesses Can Take:

- Implement SMS 2FA on Customer Accounts: Require customers to verify their identity through a second authentication method, such as a one-time SMS code or an authenticator app.

- Educate Customers: Provide resources to help customers recognise phishing attempts and avoid clicking suspicious links.

- Monitor and Notify of Suspicious Activity: Send SMS alerts to notify customers of unusual login attempts or account changes.

- Use Trusted Messaging Platforms: Ensure all text messages are sent through secure and verified channels to avoid spoofing.

- Limit Sensitive Information in Texts: Never include full account numbers, passwords, or other sensitive data in SMS communications.

- Encourage Strong Passwords: Regularly remind customers to use unique, complex passwords alongside 2FA for added security.

By implementing these strategies, businesses can actively reduce the risk of scams and build stronger, more secure relationships with their customers.

Start Talking Today

T – Talk - talk to your friends, family, neighbours and colleagues about a scam you have come across or ask if they have come across any scams and want to share information

A – Ask - asking a simple question like “Have you ever been scammed?” or “How many scams a day do you get?” can get a conversation started.

L – Listen – hearing about scam stories/experiences is helpful and showing someone you care can improve their state of mind and comfort to open up about scams.

K – Keep talking – the more we talk about scams, the less likely we will get involved in one and the less stigma talking about scams will carry.

Four Signs That it’s a Scam

- A scammer is pretending to be from an organisation you know – scammers often pretend to be contacting you on behalf of the government and may use a real name, like Centrelink, the ATO or Australia Post. Others may pretend to be from a well-known business such as a bank, utility company or retail business.

- A scammer is saying that there’s a problem – scammers will generally say that you are in trouble, owe money, have a problem with an account or that one of your family members has had an emergency.

- A scammer is pressuring you to pay them immediately – more often than not, scammers will threaten you with an account closure, device takeover, fine, arrest or deportation to convince you to act before you think about the situation at hand.

- A scammer is telling you to pay them in a specific way – scammers will often insist that you only pay them in a specific way, with the most common methods via bank transfer, gift card or even through digital currency such as Bitcoin.

Have You Been Scammed?

If you think you have been scammed, report it to Scamwatch immediately via the Scamwatch website. Reporting a scam helps the ACCC to warn people about current scams, monitor trends and disrupt scams where possible.

Find out where to get help.

Enhance Your Security with Notifyre

Take the next step in protecting your business with tools like 2-factor authentication.

Big Impact, Low Cost with Online SMS

Get unbeatable value with Notifyre’s pay-as-you-go SMS. Send smarter, save more!

Online SMS Service

Online SMS Service SMS Marketing Laws

Discover Australia's SMS marketing laws and the requirement for SMS consent.

SMS Laws Explained

SMS Laws Explained

Secure, safeguarded SMS and fax service

Our SMS and fax gateway is compliant with privacy laws, ensuring your business data stays secure. Notifyre’s secure messaging tools keeps your online fax secure and SMS data protected at all times.