Table of Contents

How to Fax the IRS: A Step-by-Step Guide

Tax season happens yearly between January and April, and during this time, US citizens file their taxes with the IRS. Many taxpayers prefer to fax their documents for speed and security. Notifyre is the ideal online fax service for IRS submissions, offering features like large file uploads, multiple file attachments, and an organized fax inbox. Notifyre offers pay per fax page sending making it the most secure and affordable way to send faxes to the IRS each year. Users can simply top us their account and use the funds to send faxes, these funds never expire so can be used year after year.

How to Fax to IRS

To fax IRS, Follow these steps to fax to IRS using Notifyre’s secure online fax service:

Sign Up for Notifyre – Create an account on Notifyre’s website.

Prepare Your Documents – Ensure all forms are complete. Scan or take a photo of these files to convert them into a digital file.

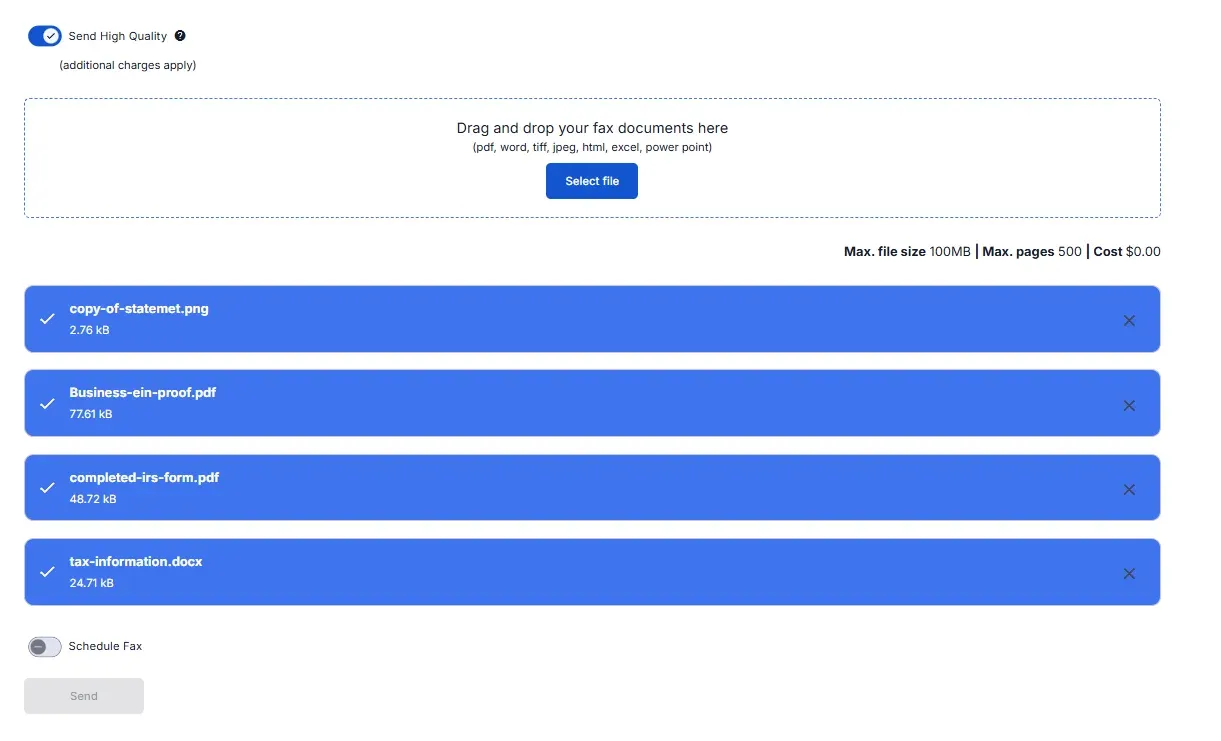

Upload Your Files – Notifyre allows you to attach multiple documents in a single fax.

Enter the Correct IRS Fax Number – Find the correct IRS fax number based on your tax form submission.

Send Your Fax – Click send and track your fax in real time.

Resend If Necessary – If the IRS fax line is busy, schedule your fax for a later time.

Confirmation of Delivery – Receive email confirmation when your fax has been delivered successfully.

Fax the IRS During Off-Peak Hours

When faxing the IRS, it’s important to know that if their fax lines are busy, your fax could fail. This is not due to an issue with Notifyre’s online fax service, it simply means that the IRS cannot receive faxes at that moment because their fax machines are overloaded.

To increase the success of your fax submission, try sending it:

Early in the morning or late at night

On weekends when traffic is lower

Using Notifyre’s scheduling feature to automatically send at a quieter time

By choosing the right time to fax, you can avoid delays and ensure your IRS documents are successfully transmitted.

Fax IRS: Where to Find IRS Fax Numbers

The IRS has multiple fax numbers for IRS depending on the type of document you are submitting. Be sure to check the official IRS website to confirm the correct fax number for the IRS before sending your documents.

IRS fax numbers sourced from the IRS website.

Using the wrong fax number for the IRS can lead to processing delays. Always verify the correct number on the IRS website or your tax form instructions before faxing.

IRS Form Number | Description | IRS Fax Number |

|---|---|---|

Form 8918 | Reportable Transaction Disclosure Statement | 1-844-253-5607 |

Form 8806 | Information Return for Acquisition of Control | 1-844-249-6232 |

Form 8023 | Tax-Free Reorganization | 844-253-9765 |

Form 8886 | Reportable Transaction Disclosure Statement (RTDS) | 844-253-2553 |

Form 2553 | Election by a Small Business Corporation | 855-887-7734 (CT, DE, DC, GA, etc.) 855-214-7520 (AL, AK, AZ, AR, CA, CO, FL, etc.) |

Form 637 | Application for Registration (Excise Tax) | 855-887-7735 |

Form 8962 | Premium Tax Credit | 1-855-204-5020 |

Form 1040 | Individual Tax Return | Cannot be faxed directly to IRS. It can only be faxed to your accountant who can file on your behalf. |

Form 2848 | Power of Attorney and Declaration of Representative | Fax numbers available at - https://www.irs.gov/instructions/i2848 |

Form 8809 | Request for Extension of Time to Furnish Statements to Recipients | 877-477-0572 (within the US) 304-579-4105 (outside the US) |

Form 3115 | Application for Change in Accounting Method | 844-249-8134 |

Form 8233 | Exemption From Withholding on Compensation for Non-resident Alien | 267-941-1365 |

Form 8850 | Pre-Screening Notice and Certification Request for Credits | Fax numbers available at: https://www.dol.gov/agencies/eta/wotc/contact/state-workforce-agencies |

Form 8505 | Request for Electronic Filing Waiver (for those facing hardship) | 877-477-0572 (within the US) 304-579-4105 (outside the US) |

Form 8802 | Application for United States Residency Certification | 877-824-9110 (within the US, toll free)

|

Form SS-4 | Application for Employer Identification Number (EIN) | 855-641-6935 (within the US) 304-707-9471 (outside the US) |

Applying for an EIN (Employer Identification Number)

If you need to apply for an Employer Identification Number (EIN), the IRS provides a dedicated EIN fax number for submitting your application. Before sending your documents, it's important to verify the correct IRS EIN application fax number to avoid delays. Using a reliable online fax service like Notifyre ensures that your IRS EIN fax submission is sent securely and successfully. Always double-check the IRS fax EIN details on the official IRS website to ensure timely processing of your EIN request.

Why Choose Notifyre for Faxing to the IRS?

No Fax Machine Required

Forget outdated hardware—send faxes digitally without a phone line or fax machine. With Notifyre, you can fax from computer, tablet, or smartphone, making it easier than ever to send documents to the IRS.

Send Large Faxes with Ease

Need to send multiple pages? Notifyre lets you upload and send large fax documents without worrying about file size restrictions.

Supports Multiple File Formats

Notifyre supports a variety of file formats, including PDF, Word, Excel, and more, so you can fax any type of document with ease.

Pay-as-You-Go Pricing

With Notifyre, you only pay for the faxes you send with no monthly subscriptions or hidden fees. This flexible, cost-effective model is ideal for both occasional and frequent fax users. Funds will never expire so you can use them again when it’s time to file tax forms again!

High-Quality Fax Transmission

By default, Notifyre sends faxes in Standard Quality (200 x 98 DPI), but for an extra cost you can upgrade to High Quality (200 x 196 DPI) for sharper, more precise documents that is perfect for tax forms and legal paperwork.

Secure and Compliant

For businesses handling sensitive tax information, Notifyre provides a HIPAA compliant fax service, and is ISO 27001 certified, ensuring your documents are secure and confidential.

Fax the IRS with Confidence Using Notifyre

Faxing your tax documents to the IRS is simple and secure with Notifyre. Our online fax service allows you to send large files, schedule faxes during off-peak hours, and track your submission in real time. Plus, with pay-as-you-go pricing and HIPAA compliant security, you can ensure your sensitive tax information is protected.

Send Your IRS Fax Securely with Notifyre

Ensure your tax documents reach the IRS quickly and securely. Sign up for Notifyre and fax with confidence today!

Fax From Email

Create a new email, attach your fax document and enter the recipient’s fax number.

Explore Email To Fax

Explore Email To Fax Fax with Confidence

Notifyre’s HIPAA compliant fax service is built for healthcare with access controls, audit trails and encryption.

Explore HIPAA Compliant Fax

Explore HIPAA Compliant Fax